Introduction

The American market for glacial acetic acid is a critical barometer for the health of numerous downstream industries, from pharmaceuticals to textiles. As a high-purity form of acetic acid (typically 99.5% or higher), this versatile chemical is a fundamental building block and solvent. Buyers and procurement specialists across the continent are currently navigating a complex landscape shaped by fluctuating raw material costs, evolving environmental regulations, and shifting global trade patterns. Understanding these dynamics is no longer just beneficial—it's essential for maintaining competitive advantage and supply chain resilience.

This article provides a comprehensive outlook on the American glacial acetic acid market, analyzing the factors that buyers are watching most closely. We will delve beyond simple price tracking to explore the underlying drivers, examine the product's key specifications that impact performance, and highlight strategic sourcing approaches. For businesses reliant on this essential chemical, from small manufacturers to large conglomerates, informed procurement is the cornerstone of operational stability and cost management in an unpredictable environment.

Understanding Glacial Acetic Acid: Product Specifications and Purity

Not all acetic acid is created equal. The term "glacial acetic acid" specifically refers to the anhydrous (water-free) form of acetic acid, which solidifies into ice-like crystals at temperatures below 16.7°C (62°F), hence the name "glacial." The defining characteristic is its exceptional purity, usually at a minimum of 99.5% concentration. This high purity is not a mere technicality; it is a critical performance parameter that directly influences reaction yields, product quality, and process efficiency in sensitive applications. Impurities like water, aldehydes, or formic acid can catalyze unwanted side reactions, degrade final products, or corrode equipment.

Key specifications that buyers must scrutinize include assay (purity percentage), water content, color (APHA), and iron content. For instance, in the production of pharmaceuticals like aspirin (acetylsalicylic acid) or in the synthesis of purified terephthalic acid (PTA) for PET plastics, even trace impurities can be detrimental. Furthermore, packaging and handling specifications are vital. Glacial acetic acid is highly corrosive and typically shipped in specialized containers such as isotanks, lined drums, or intermediate bulk containers (IBCs) made from corrosion-resistant materials like stainless steel or certain polymers. Understanding these product nuances is the first step in effective procurement and risk mitigation.

Key Market Drivers and Price Trends in America

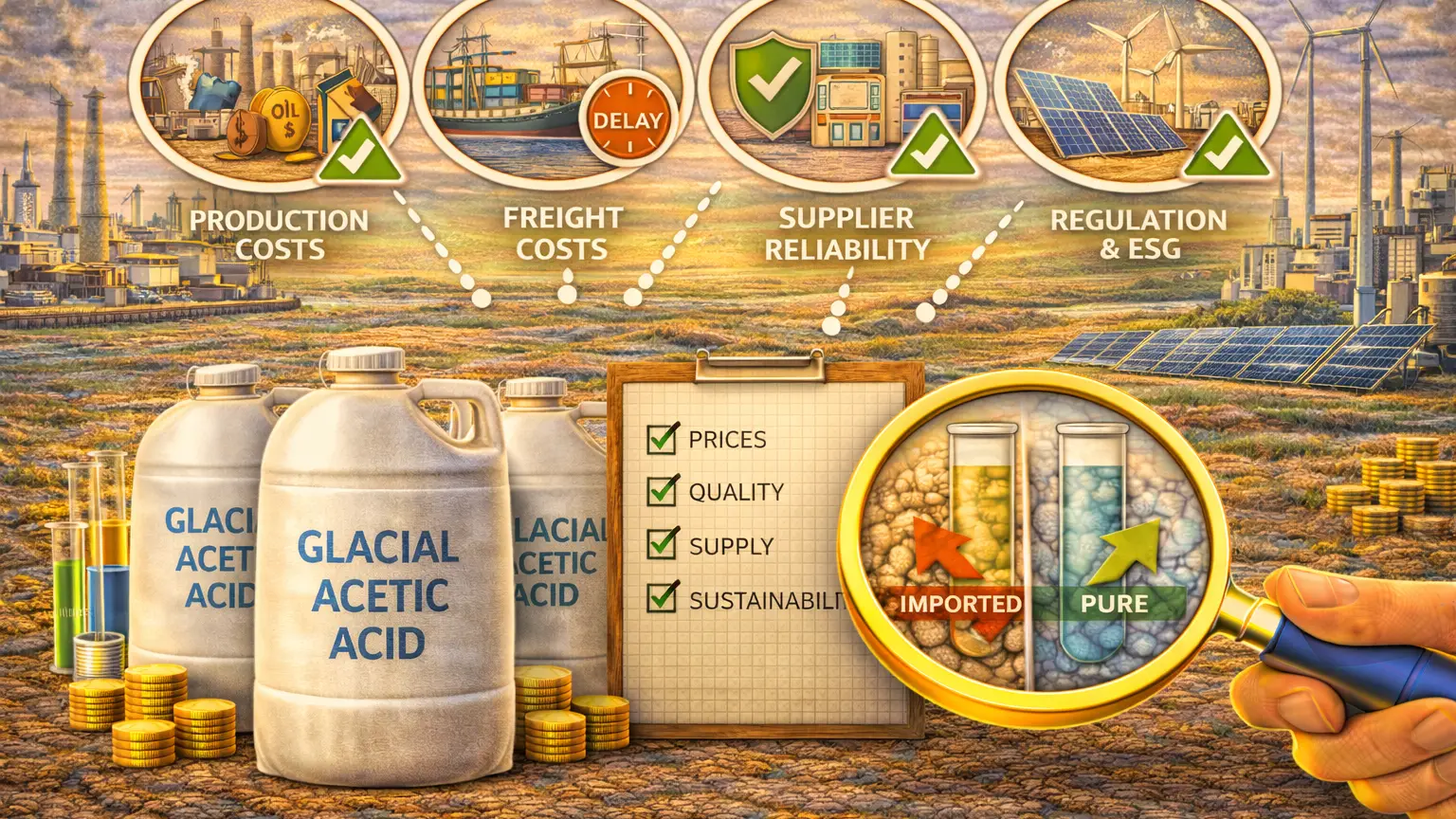

The price and availability of glacial acetic acid in the American market are influenced by a multifaceted set of drivers. Primarily, the cost of key feedstocks—methanol and carbon monoxide—plays a dominant role, as most acetic acid is produced via the methanol carbonylation process. Volatility in natural gas prices, a primary source for methanol production, directly cascades down to acetic acid costs. In recent quarters, North America has experienced significant fluctuations due to changes in natural gas feedstock economics and operational challenges at major production facilities.

Beyond feedstocks, demand from core end-use sectors dictates market tightness. The vinyl acetate monomer (VAM) segment, used in paints, adhesives, and coatings, is the largest consumer. Strength in construction and automotive sectors thus propels demand. Similarly, demand for purified terephthalic acid (PTA) for polyester and PET packaging influences market dynamics. Geopolitical factors and trade flows are also crucial; while the U.S. has substantial domestic production, imports from regions like Asia and the Middle East can impact local pricing. Buyers are closely monitoring plant turnaround schedules, production outages, and inventory levels at major producers like Celanese and LyondellBasell for signals of market direction.

Primary Applications and End-Use Industries

The utility of glacial acetic acid spans a remarkable range of industries, making it a true workhorse chemical. Its primary application is as a chemical intermediate. Over 40% of global production is used to make Vinyl Acetate Monomer (VAM), a key component in water-based paints, adhesives, paper coatings, and textiles. Another major derivative is Purified Terephthalic Acid (PTA), the precursor to polyester fibers, resins, and PET plastic bottles, linking acetic acid demand directly to the textiles and packaging industries.

Beyond intermediates, glacial acetic acid serves as a high-purity solvent and reagent. In the pharmaceutical industry, it is used in the synthesis of antibiotics, vitamins, and hormones. In food processing, it is the key component of vinegar, but in its glacial form, it is used as an acidity regulator and preservative (designated as E260). Other significant uses include the production of acetic anhydride for cellulose acetate (used in photographic film and cigarette filters), as a descaling agent, and in the manufacture of various esters for solvents and fragrances. This diverse application portfolio ensures that demand remains robust but also exposes the market to downturns in any one sector.

Supply Chain Dynamics and Sourcing Considerations

The North American glacial acetic acid supply chain is a complex network involving integrated chemical giants, merchant producers, distributors, and logistics providers. Production is concentrated with a few major players who often consume a portion of their output captively for derivative production. This integration means that merchant market availability can sometimes be tight, especially during periods of high derivative demand or plant maintenance. Logistics present another layer of complexity; as a corrosive Class 8 hazardous material, transporting glacial acetic acid requires adherence to strict DOT regulations, specialized tanker trucks or railcars, and proper storage facilities.

For buyers, navigating this landscape requires a strategic approach. Key considerations include securing supply agreements that balance spot and contract purchasing to manage price volatility. Evaluating supplier reliability goes beyond price to include audit trails, quality consistency, safety records, and logistical capabilities. Furthermore, with increasing focus on sustainability, buyers are now assessing the environmental footprint of their chemical procurement. Some suppliers are offering bio-based acetic acid routes, which, while currently a niche, represent a growing consideration for environmentally conscious brands. Diversifying the supplier base, including evaluating reputable international partners for supplemental supply, can also enhance supply chain security.

The Role of Reliable Suppliers and Strategic Procurement

In a market subject to volatility, the choice of supplier becomes a critical strategic decision. A reliable supplier acts as more than just a vendor; they are a partner in supply chain risk management. For a product like glacial acetic acid, reliability is measured by consistent quality (meeting stringent purity specs every time), transparent communication about market changes and potential disruptions, and robust logistical support to ensure on-time delivery despite regulatory hurdles. Suppliers with a global network, such as Chemtradeasia.com, can provide buyers with valuable market intelligence and flexible sourcing options, accessing pools of supply from different regions to mitigate local shortages.

Strategic procurement involves leveraging such partnerships for long-term benefit. This includes collaborating on forecast sharing to help suppliers plan, exploring contract structures with price adjustment mechanisms linked to feedstock indices, and conducting joint audits of storage and handling facilities. For American buyers, partnering with a globally connected supplier provides a vital window into international price arbitrage opportunities and emerging production trends in Asia or Europe that could affect the domestic market. Ultimately, the goal is to transform the procurement of this essential chemical from a transactional cost center into a value-driven, resilient component of the overall business strategy.

Conclusion

The American glacial acetic acid market outlook demands vigilance and sophistication from buyers. Success hinges on a deep understanding of the product's critical specifications, a clear analysis of the feedstock and demand-driven price drivers, and an appreciation for its diverse industrial applications. In today's environment, simply finding a supplier is insufficient. Building a resilient supply chain requires forging strategic partnerships with reliable, knowledgeable suppliers who can ensure quality, consistency, and transparency.

By focusing on strategic procurement practices—balancing contract and spot purchases, diversifying sources, and prioritizing supplier reliability over the lowest short-term price—businesses can navigate market volatility effectively. As global economic and regulatory landscapes continue to evolve, an informed, proactive approach to sourcing glacial acetic acid will be a defining factor in maintaining operational continuity, cost competitiveness, and long-term growth for countless industries across the American economy.

Leave a Comment